Scalping Trading: Tools, Tips, and Tactics for Fast Forex Action

Ever wondered what scalping trading really feels like? Let me walk you through it. It’s fast, focused, and full of action – perfect if you’re the type who likes quick decisions and even quicker profits. In this Market Investopedia blog.

I’ll show you how scalpers use 1-minute charts, position sizing, and sharp tools (like scalping trading apps) to catch small price movements in the Forex market.

The course covers real strategies, real trades, and how to jump right in – whether you’re a new trader or an experienced trader. We’ll explain everything scalp traders do, from picking the right currency pairs to managing trades in seconds, so you can stay sharp, and make the most of every trade.

Want to trade fast and smart? Let’s get started; you’ll love it.

Scalping Trading: Fast Hands, Sharp Mind & A Trader’s Secret Weapon

Let me guess… you’re the kind of person who doesn’t like waiting.

You check your trades like you check your phone – every few minutes. You love fast action, quick moves, and getting in and out before the rest of the crowd even knows what’s happening.

If that’s you? Welcome to scalping trading – the ultimate fast-paced strategy in the Forex world.

Forget holding positions for days or weeks. Scalp traders are in and out within minutes (sometimes seconds), riding small price movements for small profits – but stacking those little wins into one big day.

This isn’t just trading. This is adrenaline.

So, What Is Scalping Trading Really?

In simple terms: scalping is a trading strategy that focuses on making lots of trades in a short period of time, aiming to profit from tiny fluctuations in price.

You’re not trying to catch the big fish. You’re after the fast, frequent nibbles – and lots of them.

Most scalp traders work with currency pairs in the Forex market, where volatility is your best friend. It’s fast. It’s liquid. And with the right plan? It’s profitable.

You’ll often find scalpers glued to the 1-minute chart, watching for precise entry points and executing rapid-fire trades. This is scalping strategie im 1- Minuten Chart – the classic battleground for the quick and the skilled.

How Does Scalping Actually Work?

Let’s break it down:

- You enter a trade when your strategy signals a potential move (maybe a bounce-off support or a break-through resistance)

- You exit that trade quickly — sometimes within 1–5 minutes.

- You rinse and repeat, making 10, 20, even 50 trades in a single day.

The goal isn’t to make $100 in one trade – it’s to make $5 twenty times, & because you’re entering and exiting positions quickly, you reduce your exposure to major market reversals or news events.

Scalping Trading Strategies (That Actually Work)

Now let’s talk about the sauce – the actual scalping trading strategies that work best in the 1-minute or 5-minute charts.

1. Moving Average Crossovers

The classic. Use two exponential moving averages [say, the 9 EMA (Exponential Moving Average) and 21 EMA].

~ Buy when the short-term crosses above the long-term.

~ Sell when it crosses back below.

Combine it with RSI(Relative Strength Index) or MACD(Moving Average Convergence Divergence) for confirmation.

2. Support and Resistance Zones

Mark key levels where the price reacts.

Wait for a bounce or breakout, and scalp the short burst in price movement.

Perfect for currency pairs like EUR/USD or GBP/JPY with tight spreads.

3. Breakout Scalping

Identify tight consolidations, then trade the breakout with tight stop-loss and modest take profit. Best used during major sessions like London or New York, where volume is high.

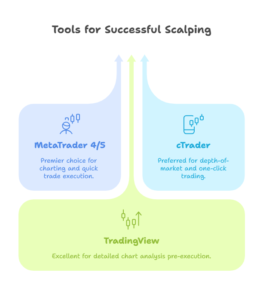

Tools & Platforms

Speed is everything in scalping. So you need a platform that doesn’t lag, freeze, or cost you that perfect entry.

Here are some of the best Scalping Trading apps to start with:

- MetaTrader 4/5 (MT4/MT5) – Still the GOAT for charting and fast execution.

- cTrader – Loved by pro scalpers for depth-of-market and one-click trading.

- TradingView – Great for chart analysis before jumping to execution platforms.

Look for brokers that offer tight spreads, low latency, and no trade delays – because in scalping, even a few seconds can cost you.

How to Learn Scalping Trading (Without Burning Out)

Learning to Scalping Trading Lernen is not just about charts. It’s about discipline, control, and emotional strength.

Here’s how you start:

- Backtest Your Strategy

Before risking money, test your strategy on historical data. This builds confidence and filters out bad setups. - Demo Account First

Start scalping on demo – it helps you get used to the pace and execution without pressure. - Use Risk Management Tools

Always use position sizing based on your account size. Scalping without proper lot sizing? That’s gambling. - Focus on One or Two Currency Pairs

Know your pair’s behavior, news impact, and volatility. Avoid switching every day. - Set a Daily Goal (and STOP When You Hit It!)

Overtrading kills accounts. Learn to walk away with your wins intact.

Scalping Isn't for Everyone... But It Might Be for You

Scalping requires:

- Fast decision-making

- Comfort with tight stop losses

- Laser focus

- The ability to accept frequent small wins (and occasional quick losses)

If that sounds exciting to you? You’re probably built for this.

But if you get easily stressed, distracted, or emotional about trades – you might want to try swing or position trading instead.

Scalping rewards the calm and consistent – not the impulsive.

The Power of Position Sizing in Scalping

Here’s a quick tip many newbies ignore: position sizing is everything.

You’re taking a lot of trades, and even if you’re only risking 0.5% –1% per trade, it adds up. Use calculators to plan your lot sizes and stop-loss distance, based on your account size.

No winging it. No revenge trades.

Proper sizing keeps your account alive – and growing.

Final Thoughts – Is Scalping the Forex Superpower You’ve Been Looking For?

Let’s be honest: scalping isn’t magic. It’s not easy. But for those who master it? It’s one of the most rewarding ways to trade – both financially and mentally.

You’re in control. You know your numbers. You act, not react.

You don’t need a crystal ball. You just need a solid scalping trading strategy, a tested plan, and the discipline to follow it.

In a market where seconds matter, scalping makes you sharp, fast, and focused – and if you’re trading Forex, it can be your edge.

Ready to give it a shot?

Open your chart, switch to that 1-minute chart, and just start observing.

Mark support. Watch the candles. Try paper trades.

Because the only way to get good at scalping… is to start scalping.

Let’s ride the wave, one pip at a time.

FAQ

Scalping trading is all about fast moves and tiny profits done over and over. Traders, aka scalpers, jump in and out of the market quickly, trying to grab a few pips from small price movements. Most scalpers use tools like the 1-minute chart, the 9 EMA and 21 EMA, and fast-execution apps to time their entries and exits like a pro. It’s quick, it’s strategic, and it’s laser-focused.

Not usually but it depends on your broker. Some brokers don’t allow scalping because it involves frequent, high-speed trades that can strain their systems. Others welcome scalpers and even offer features that help. So before you start clicking away on your trades, make sure your broker supports scalping strategies. Always read the fine print or just ask their support team.

Honestly? It can be at first. Scalping requires a sharp mindset, solid technical analysis skills, and the ability to stay focused under pressure. You’re working with short timeframes, which means fast decisions and tight risk management are key. But once you understand position sizing, use the right tools (like RSI, MACD, or EMAs), and practice enough, it becomes much more manageable.

Scalp trading (aka scalping) is a Forex trading strategy that focuses on making multiple small trades within a single day. Instead of waiting hours or days for a trade to play out, a scalp trader might enter and exit positions quickly – sometimes in just seconds or minutes. The goal is to accumulate small profits that add up over time, especially when trading active currency pairs like EUR/USD or GBP/JPY.