Leveraged Buyout (LBO): Appreciating the Strategy

Introduction

A leveraged buyout (LBO) is a financial strategy where a company acquires another business primarily using debt to finance the purchase. According to Market Investopedia, this approach allows management teams and private equity firms to gain control of a target company with minimal equity investment. Typically, the acquired company’s cash flow is used to repay the substantial debt over time, making LBOs a widely used method in corporate acquisitions.

What is a Leveraged Buyout (LBO)?

When a firm is acquired through the use of a considerable amount of borrowed capital, this type of purchase is referred to as a leveraged buyout (LBO). Due to the fact that the loan that is utilized in the deal is secured against the assets of the target firm, the acquired business itself is responsible for a significant portion of the business’s financial risk. Through the use of this strategy, private equity firms are able to acquire enterprises with a relatively low initial financial commitment.

How LBOs

The LBO process typically follows these steps:

- Identifying the Target Company – A potential acquisition must have strong cash flow and valuable assets to support the borrowed funds.

- Structuring the Deal – The acquiring company raises capital, primarily through high debt, and invests a smaller portion as equity.

- Closing the Acquisition – The deal is finalized, and the target company comes under new ownership.

- Managing the Investment – The new owners improve operations to enhance profitability and ensure debt repayment.

- Exit Strategies – After increasing the value of the company, investors exit through resale, public offering, or a merger.

Main Participants in an LBO

- Private Equity Firms – These investors drive LBOs by financing acquisitions and managing restructuring efforts.

- Management Teams – Often, existing leadership remains in place or is replaced to maximize business performance.

- Lenders and Banks – Provide the debt necessary for funding the deal, typically through loans and bonds.

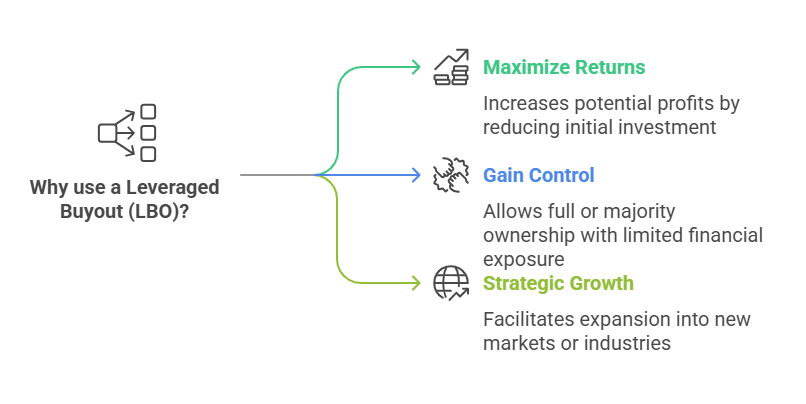

Why Businesses Use LBOs?

Companies and investors use LBOs for several reasons:

- Maximizing Returns – Using borrowed capital reduces the initial investment, increasing potential profits.

- Gaining Control – Investors gain full or majority ownership with limited personal financial exposure.

- Strategic Growth – Allows expansion into new markets or industries by acquiring existing companies.

Risks Connected to Leveraged acquisitions

While LBOs can be highly profitable, they come with significant risks:

- High Debt Burden – Excessive debt increases financial strain and potential bankruptcy risk.

- Economic Downturns – If cash flow declines, meeting debt obligations becomes difficult.

- Operational Challenges – Management teams must improve efficiency to justify the financial leverage.

Features of a Good LBO Target

Not all companies are suitable for an LBO. The ideal target company generally possesses:

- Strong Cash Flow – Ensures debt repayment without excessive strain.

- Established Market Position – Reduces uncertainty and enhances profitability.

- Cost-Cutting Opportunities – Provides room for operational improvements and increased value.

Types of Financing Used in LBOs

LBOs rely on multiple funding sources:

- Bank Loans – Traditional debt financing with fixed interest payments.

- High-Yield Bonds – Also known as “junk bonds,” these offer higher returns but carry greater risk.

- Mezzanine Financing – A hybrid of debt and equity with flexible repayment structures.

Strategies for Exit from Leveraged Buyouts

After acquiring and improving a business, investors seek to exit and realize their gains through:

- Selling to Another Company – A larger business acquires the improved target company.

- Initial Public Offering (IPO) – Listing shares on the stock exchange to raise funds and distribute profits.

- Recapitalization – Refinancing debt and distributing profits while retaining ownership.

Examples of LBOs

Many LBO transactions have achieved great success, such as:

- The Acquisition of Hilton Hotels – A major private equity deal that improved profitability.

- Dell’s Takeover by Michael Dell and Silver Lake Partners – A strategic move to restructure and grow the company privately.

At last

The use of leveraged buyouts provides investors and management teams with a potent method for acquiring companies with a low amount of initial capital for the acquisition. Due to the huge amount of debt that is involved, they include dangers, despite the fact that they offer chances for substantial rewards. It is essential to have solid financial planning, efficient management, and a well-defined exit strategy in order for a leveraged buyout to be successful.

FAQ

Private equity firms use LBOs to acquire businesses with limited capital while maximizing returns through operational improvements.

Failure to repay debt can lead to financial restructuring, asset sales, or bankruptcy.

While most LBOs involve high debt, the level varies depending on the deal structure and risk tolerance

Yes, management teams often invest alongside private equity firms to retain control and align interests.

LBOs are common in industries with stable cash flow, such as manufacturing, healthcare, and retail.